American Express is a multi-national US-based financial corporation known for its luxury credit cards and charge cards across the globe. It is both a card issuer and a credit card network as you get cards from AmEx in which the payment is processed by its own network and third-party network. The corporation came into existence in the year 1993 and in a short time period, it become the most premium card service provider in the country. As of November 2022, there are over 13 lakh credit card users and the numbers have lately decreased in one year.

Acting as both a credit card issuer and a credit card network. Amex has its own unique way and provides customers with exclusive benefits and offers. Here you can all the major details regarding credit cards offered by the bank.

American Express Platinum Card

On-boarding benefits

Taj and Vivanta vouchers worth INR 45,000

Rewards Rate

1 MR on every INR 40, Rewards on International Spends and 5X rewards points on transactions via AMEX reward multiplier portal.

Joining Fees

Rs 60,000 (Plus applicable Taxes)

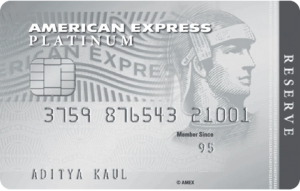

American Express Platinum Reserve Credit Card

Welcome Benefits

Welcome benefit of Complimentary MMT Black Elite and Club Vistara Silver Tier membership on spending over 1 lakh inside 90 days of getting issued.

Rewards Rate

Get 4 reward points on every spend of Rs 150 on retail including utilities, insurance and education. Get 20 Reward points on every spend of Rs 150 on Myntra and other online shopping platforms.

Joining Fees

INR 2500 + Taxes

Features of AU Small Finance Bank Credit Cards

Wide range of credit cards

Global acceptance

Reward points

Fuel surcharge waiver

Contactless payment

Documents required for AU Small Finance Bank

Proof of identity

You will need to provide a valid government-issued ID proof such as Aadhaar card, PAN card, Voter ID card, or Passport.

Income proof

You will need to provide income proof such as salary slips, bank statements, IT returns, or business documents, depending on your income source.

Proof of address

You will need to provide a valid address proof such as Aadhaar card, Passport, Voter ID card, Driving license, or Utility bills (electricity, water, gas, telephone, etc.).

Passport size photograph

You will need to provide one or two passport size photographs.